Do you want to raise financially smart kids? Greenlight Financial is making it a reality.

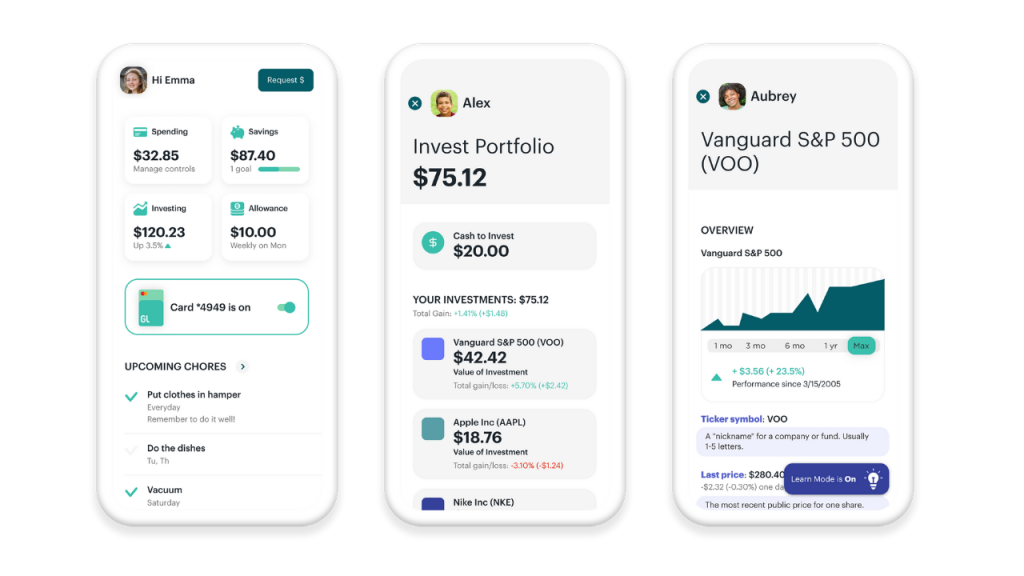

The company who launched a parent-managed debit card and app for children to teach money management skills has just announced Greenlight Max, the first educational investing platform designed for kids. According to the Greenlight Card website, the new program for kids is an “all-in-one plan [that] teaches them money management and investing fundamentals—with real money, real stocks and real-life lessons.”

photos: Courtesy of Greenlight

With the understanding that many adults don’t even know how to get started in the investment realm, Greenlight has spent the past four years using customer feedback and expertise in education and family financial technology to develop the new plan.

Tim Sheehan, co-founder and CEO of Greenlight shares, “At Greenlight, we know that financially-smart kids will have happier and healthier lives. Investing is one of the most important pieces of the personal-finance puzzle. That’s why we launched Greenlight Max—so parents can lay the foundation for building generational wealth.”

So how does it work? Greenlight Max builds off of the Greenlight Card so you’ll need to sign up and set up your debit cards first. After that, Kids will be able to research stocks with analysis powered by Morningstar, in addition to learning from in-app educational content, track their portfolio and propose investments––with parental approval, of course.

The Greenlight Max plan includes safety features like cell phone, purchase and identity theft protection and the Greenlight Black Card. You can sign up the entire family for $9.98 per month (and no fees for investing!) at greenlightcard.com.

––Karly Wood

Feature photo: iStock

RELATED STORIES

This Is the Average Allowance by Age, According to Greenlight

6 Tips to Help Teach Financial Independence to Kids

5 Reasons Why We Discuss Our Finances With Our Kids